Full year gold demand totalled 3,923.7 tonnes in 2014 (from 4,087.6t in 2013). The 4% year-on-year drop was unsurprising as consumer demand was never likely to match the previous year’s record surge. Total annual supply was virtually unmoved at 4,278.2t. Growth in mine supply was balanced by a decline in recycling volumes to a seven-year low.

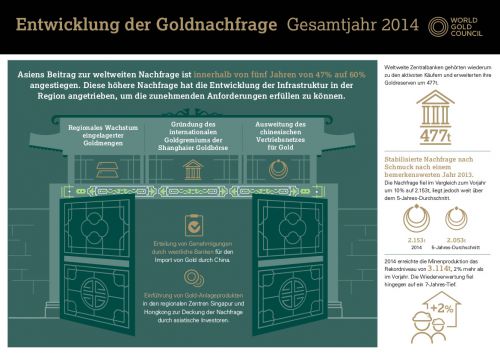

Jewellery: 2014 was always going to be a difficult year for jewellery demand, contending with comparisons to phenomenal strength in 2013. After a steep drop in Q2, demand for gold jewellery gradually recovered, culminating in the strongest Q4 since 2007. Full year statistics show the sector down by 10% at 2,152.9t, comfortably above the 2,053.0t average from the prior five-years.

Investment: Net investment demand of 904.6t in 2014 was 2% above the 2013 total of 885.4t. The positive year-on-year comparison is somewhat misleading: ETF outflows slowed to a fraction of the hefty 2013 total and therefore acted as less of a drag on investment. Demand for bar and coins among smaller investors dropped by 40%. This was again largely a function of the sheer strength of demand in 2013.

Technology: Gold demand in the Technology sector contracted to 389t - the lowest level since 2003. Sluggish economic conditions in key markets and ongoing substitution away from gold were the driving force behind the 5% drop.

Central Banks: Seeking continued diversification away from the US dollar, central banks absorbed 477.2t of gold in 2014, 17% above 2013’s impressive 409 tonnes. This was the second highest year of central bank net purchases for 50 years, after the 544 tonne addition to global gold reserves reported in 2012.

Supply: The total annual supply of gold was static at 4,278.2t in 2014. Despite record annual mine production, growth in mine supply was neutralised by shrinking volumes of recycling.

Copyright (C) 2015 by WGC